Debt can often feel overwhelming, but with the recent Federal Reserve rate cut, I see a unique opportunity for Black families to lower their debt burdens and boost savings. By refinancing loans at these reduced interest rates, you can significantly cut monthly payments and redirect those funds towards building wealth and financial stability. This moment could pave the way for transformative financial change, allowing us to reclaim our financial futures and invest in what truly matters.

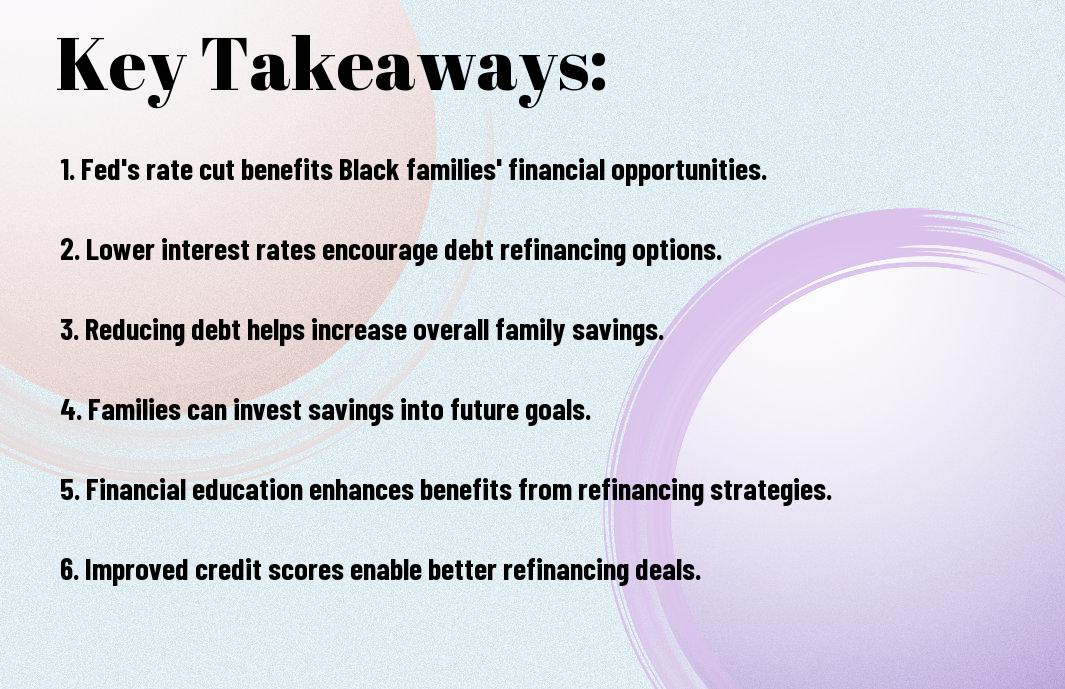

Key Takeaways:

- Refinance Opportunities: The Fed’s rate cut provides an advantageous environment for Black families to refinance existing loans at lower interest rates, potentially decreasing monthly payments.

- Debt Reduction: Lower rates can lead to significant savings on mortgages and other debts, allowing families to reduce their financial burdens and improve their overall economic situation.

- Increased Savings: With reduced debt payments, families have the opportunity to allocate more funds towards savings, investments, and financial goals, contributing to long-term wealth accumulation.

Understanding the Federal Reserve’s Rate Cuts

A rate cut by the Federal Reserve can significantly impact economic conditions, primarily by lowering the cost of borrowing. This action aims to stimulate growth by encouraging spending and investment. For families, particularly those with burdensome debt, lower rates can offer a path towards financial relief and increased savings.

Historical Context of Rate Cuts

Beside the immediate economic effects, understanding the history of rate cuts provides insight into their purpose. The Fed has historically implemented cuts during economic downturns to promote growth and stabilize the economy. Knowing this context can help you grasp why such measures are taken and how they can benefit you.

Impacts on Borrowing Costs

Reserves have a direct connection to borrowing costs for consumers. As the Federal Reserve reduces interest rates, lenders typically follow suit, resulting in lower rates for mortgages, personal loans, and credit cards. This means that you could save significantly on interest payments, making it easier to manage your finances.

Understanding the impacts of lower borrowing costs is important for your financial strategy. With reduced rates, you can potentially secure loans at lower interest, which directly translates to lower monthly payments. This can assist in decreasing your overall debt and freeing up funds for savings or investments, providing a pathway to financial stability. However, it is crucial to be mindful of maintaining a good credit score to capitalize on these opportunities effectively.

The Financial Landscape for Black Families

There’s a significant disconnect in the financial landscape for Black families, shaped by systemic barriers and historical inequities. Many families experience unique challenges in accessing credit, establishing wealth, and navigating the often-complex world of finance. As we explore the impacts of recent financial policies, we can see new avenues for stabilization and growth.

Debt Levels and Challenges

The continuing issue of high debt levels among Black families poses a formidable challenge to financial stability. Factors such as student loans, credit card debt, and housing costs often burden families, making it difficult to achieve lasting financial health. Understanding the roots and impacts of these challenges is necessary for creating pathways out of debt.

Opportunities for Financial Growth

Before plunging into financial strategies, it’s necessary to recognize that opportunities for growth have emerged amid challenges. With the Fed’s recent rate cuts, you can take advantage of lower borrowing costs, opening doors to refinancing options and promoting savings.

Understanding these opportunities can lead to impactful financial decisions. Lower interest rates mean that you can potentially refinance existing debts for more affordable payments and enhance your savings through lower costs on loans and mortgages. By strategically managing your debt and investing what you save, you can foster a path toward financial independence and wealth-building for your family. This proactive approach allows you to reclaim your financial future, ensuring greater stability and prosperity for generations to come.

Refinance Options for Homeowners

Not all refinancing options are created equal. As homeowners, you need to explore various avenues, including conventional loans, FHA loans, or VA loans, which can provide you access to lower rates and better terms. Each option may cater to your unique financial situation, allowing you to make informed decisions that can significantly ease your financial burden.

Benefits of Refinancing

Below are several key benefits of refinancing your mortgage. You can potentially lower your monthly payments, reduce your interest rate, and even shorten your loan term. These improvements can enhance your cash flow, allowing you to allocate funds towards savings or investments. Moreover, refinancing may also eliminate private mortgage insurance, further increasing your savings.

Steps to Refinance Successfully

Above all, successful refinancing requires careful preparation. Start by assessing your financial situation, checking your credit score, and gathering necessary documentation. Next, shop around for lenders that offer competitive rates and terms. Finally, navigate through the application process meticulously, ensuring you understand the fees and obligations involved. Your diligence will empower you to secure a favorable outcome.

Further, I recommend being proactive during the refinancing process. Collect your income documents, including W-2s or pay stubs, and have your credit report ready, as these will aid in negotiations with lenders. Don’t overlook current interest rates—consult financial advisors and research market trends. Lastly, closely examine the closing costs involved in your refinancing deal to ensure it aligns with your financial goals. Taking these steps not only elevates your chances of success but also positions you to reap the most benefits moving forward.

Strategies for Increasing Savings

Many families can significantly enhance their savings by adopting effective strategies tailored to their needs. By actively managing your budget, prioritizing necessities, and cutting down on non-imperative spending, I can help you allocate more funds toward building a future financial cushion. Engaging in healthy saving habits today sets the stage for tomorrow’s financial security.

Budgeting and Financial Planning

An imperative first step in increasing your savings is establishing a comprehensive budget and financial plan. I recommend creating a detailed budget that outlines your income and expenses. This way, you can identify areas where you can cut costs and redirect those funds to your savings goals, paving the way for better financial decisions.

High-Interest Savings Accounts

With the right high-interest savings account, you can make your money work harder for you. These accounts typically offer better interest rates than traditional savings accounts, allowing your savings to grow more efficiently. I encourage you to shop around and compare options to find an account that suits your needs and maximizes your savings potential.

The key benefits of high-interest savings accounts are their enhanced interest rates and low-risk nature. By choosing one, I can ensure that my savings are both accessible and earn a competitive return. It’s important to note that while these accounts typically have lower fees, some may impose restrictions on the number of withdrawals or require a higher initial deposit. Be sure to read the fine print and understand the terms before committing. Making informed choices can lead to substantial growth in your savings over time.

Case Studies: Successful Refinancing Stories

Now, let’s explore some inspiring case studies of families who successfully benefited from refinancing:

- Smith Family: Refinance from 5% to 3.25%, saving $400/month.

- Johnson Family: Lowered their mortgage term from 30 years to 15 years, reducing total interest paid by $50,000.

- Williams Family: Consolidated $20,000 in high-interest credit card debt into a lower-rate mortgage, saving over $300/month.

- Brown Family: Refinanced to access $15,000 in equity for home improvements, increasing property value by 20%.

Overcoming Initial Challenges

By navigating the refinancing process, I faced initial challenges such as a low credit score and high debt-to-income ratio. I understood that these obstacles could impact my approval chances, but with diligence, I worked to raise my score by paying down some debt and ensuring timely payments. This proactive approach ultimately played a vital role in securing a favorable rate.

Long-Term Financial Benefits

On refinancing, I’ve experienced significant long-term benefits that extend beyond mere monthly savings. These advantages include increased equity in my home and financial freedom to invest in other opportunities. Understanding the implications of lower interest rates helped me to make strategic plans for my future expenses, ultimately fostering a healthier financial landscape.

The financial benefits of refinancing can be profound. I’ve noticed that by securing a lower interest rate, my monthly expenses have decreased, allowing me to allocate funds towards savings and investments. Additionally, this not only boosts my home equity over time but can also lead to a more substantial net worth. Ultimately, the decision to refinance is a long-term strategy that promotes financial stability and empowers individuals to take charge of their financial destiny.

Resources and Tools Available

For Black families exploring refinancing options, there are a variety of resources and tools designed to simplify the process. Online calculators, comparison websites, and financial advisors can help you better understand your situation and the potential benefits of refinancing. Additionally, leveraging technology such as budgeting apps can assist in tracking your spending and savings goals, ultimately enabling you to take control of your financial future.

Community Organizations and Support

After identifying the need for support, I often find various community organizations ready to assist Black families. These local and national nonprofits offer invaluable resources, including financial education workshops, one-on-one counseling, and pathways to affordable housing. By engaging with these organizations, you can access tailored advice and assistance that resonates with your unique financial circumstances.

Financial Literacy Programs

An effective way to empower yourself and your family is through financial literacy programs. Many organizations provide education focusing on personal finance management, budgeting, and understanding credit. By participating in these programs, you can build a foundation that enhances your financial well-being.

Programs often cover topics like debt management, investment strategies, and savings techniques, ensuring that you gain the knowledge needed to make informed decisions. Completing these courses can help you recognize and avoid predatory lending practices while learning how to improve your credit score. Moreover, engaging with peer support can foster confidence and accountability as you work towards your financial goals.

To wrap up

Conclusively, the Fed’s rate cut presents a significant opportunity for Black families to refinance existing debts and enhance their savings. By taking advantage of lower interest rates, you can manage your finances more effectively and reclaim control over your economic future. I encourage you to explore your options, assess your financial situation, and connect with knowledgeable lenders who can guide you through the refinancing process. This could be the key to unlocking a brighter financial outlook for you and your family.